Lotte Card’s records, which contain crucial personal information of millions of people and are responsible for an estimated 10.5 percent of the Korean Credit Card market, were recently exposed to a malicious cyberattack on the company. The cyberattack resulted in an estimated three million users’ financial information being stolen, significantly decreasing the users’ trust in the company’s ability to retain private information and thus causing a sudden reduction in users.

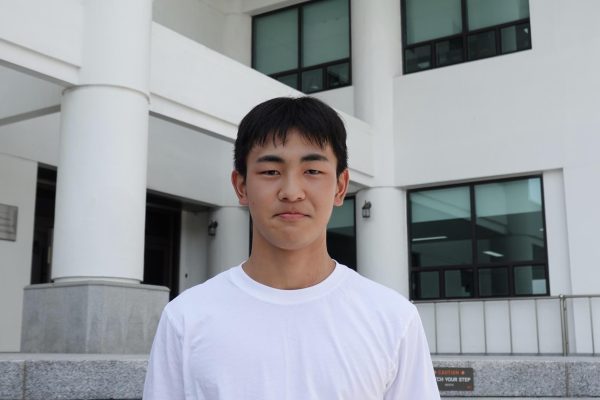

“I use my Lotte card as my main method of financial transactions,” Jake Koh (10), frequent Lotte Card user, said. “I am really worried that my personal information could have been stolen and used by someone else. I have a lot of important subscriptions that are tied to my Lotte Card account, so I am hoping that those subscriptions are not cancelled.”

Because the cyberattacks could lead to users’ money being stolen and used elsewhere, some have completely ended their transactions with the company. While Lotte Card has publicly apologized to the public in a press release, they have yet to locate the hackers and charge them with large-scale theft. However, the company has quickly created measures to compensate for its mistake, waiving fees for the affected for life, while taking on the full financial burden that may result from the attack.

“I think the cyberattack happened because Lotte Card was not fully prepared for such incidents,” Tiger Moon (10), aspiring financial analyst, said. “Credit card companies such as Lotte need to be extremely careful when it comes to cybersecurity, especially since they hold information that could lead to exorbitant financial losses if kept unchecked.”

Because Korea is a highly digital country that is shifting away from tangible currencies, credit card companies must maintain strict protocols for protecting user data and lobbying for uncompromising punishments for those who are charged with these kinds of crimes.

“I am thinking of cancelling my Lotte Card,” Steve Nave, Lotte card user, said. “I used to use it as my main credit card, but now that I am aware of the company’s lack of cybersecurity, I might have to switch to a new card. I hope the company is going to take full responsibility for my potential financial losses. I think the company should also increase lobbying to the Korean government to create harsh punishments for those who practice such cyberattacks.”

While Lotte has publicly announced that they would assume the full financial burden, the feasibility of such a responsibility has been brought into question by the public. Since the cyberattackers have not been apprehended by the police yet, it is possible that the attackers will start spending the money of the Lotte Card users from the stolen financial information.

Lotte Card lost 26,000 members in just four days after the incident, showing how quickly public trust was lost because of the attack. The company’s name has now been tied to a lack of security and susceptibility to external attacks, deeply damaging the company’s reputation that they have been building since its founding in 1989.

As more countries are turning to non-cash methods of payment that rely on the internet, cybersecurity is becoming a more pressing issue for companies. Furthermore, social media has caused a wave of distrust against Lotte Card after the incident, demonstrating the public’s quick actions to remove themselves from potential exposure of their personal information.